3.5 minute read

As a reminder, PCORI fees must be reported and paid by August 1st by filing IRS Form 720. Generally, the deadline is July 31st; however, since this date falls on a Sunday, the IRS changed the due date to August 1, 2022.

Stand-Alone HRA

If the same sponsor has no other applicable self‐insured health plans, the sponsor must pay the fee based on the average number of lives covered by the specific plan, but counting only one life per participant (e.g. excluding spouses and dependents).

HRA Integrated with Fully Insured Group Health Plan

If a plan sponsor has an HRA, which is considered a self-insured health plan, along with group health coverage that is fully insured, the plan sponsor must pay the fee for the average number of lives covered by the self-insured plan. The insurance company is responsible for the fees on the fully insured group health plan. To calculate the average number of lives covered by the self-insured plan, the plan sponsor uses the one life per participant rule (e.g. count each employee participant enrolled in coverage, but not their spouse or dependents).

HRA/FSA Integrated with Self-Insured Group Health Plan

If the same plan sponsor has another self‐insured health plan with the same plan year, then each person covered by both plans is only counted once. All individuals, including spouse and dependents covered by both plans, are counted. If the plan covers anyone who is not also covered under the other self‐insured major medical health plan, the sponsor must pay the fee for those individuals using the one life per participant rule (e.g. dependents and spouse not counted).

How to Calculate Your Own PCORI Fee

Generally, plan sponsors of applicable self-insured group health plans must use one of three methods to determine average number of lives covered under a plan for the plan year. If you are running the report on your own, employers may want to use the Snapshot Count Method. The Snapshot Count Method is based on the total number of lives covered on one date during the first, second, or third month of each quarter and dividing that total by the number of dates on which the count was made. The date picked within each quarter does not matter, so long as it’s consistent each quarter throughout the year.

HRA PCORI Fee Calculation Example

Below is ABC School District’s HRA Enrollment Count each quarter in 2021. In this example, the date selected was the middle (the 15th) of each quarter. Remember that the date picked within each quarter does not matter (as long as it’s consistent each quarter throughout the year).

- February 15, 2021 - 20 Enrolled

- May 15, 2021 - 22 Enrolled

- August 15, 2021 - 24 Enrolled

- November 15, 2021 - 26 Enrolled

Using the Snapshot Count Method, the average number of covered lives is 23 (20+22+24+26/4). Then multiply 23 average lives by the PCORI fee of $2.66 for plan years ending between September 30, 2020 and October 1, 2021. The PCORI fee would be $61.18 (23 lives X $2.66).

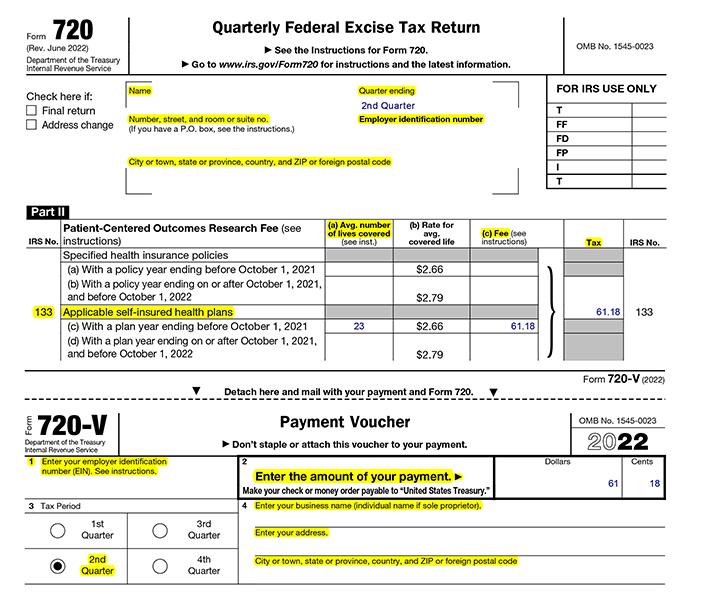

Below is a screenshot on how to complete IRS Form 720 for PCORI fees tied to an HRA for the above example:

If you have any questions, please reach out to your NIS Representative.