If you work in the human resources or benefits department, you’ve probably helped an employee or two submit a disability claim. Ever notice how quickly some get approved and how others take a while to get a determination? Why is that? The disability claim process may look simple and straight forward from the front end (submit claim application, get determination letter) but it’s a lot more complex internally.

The Claims Process

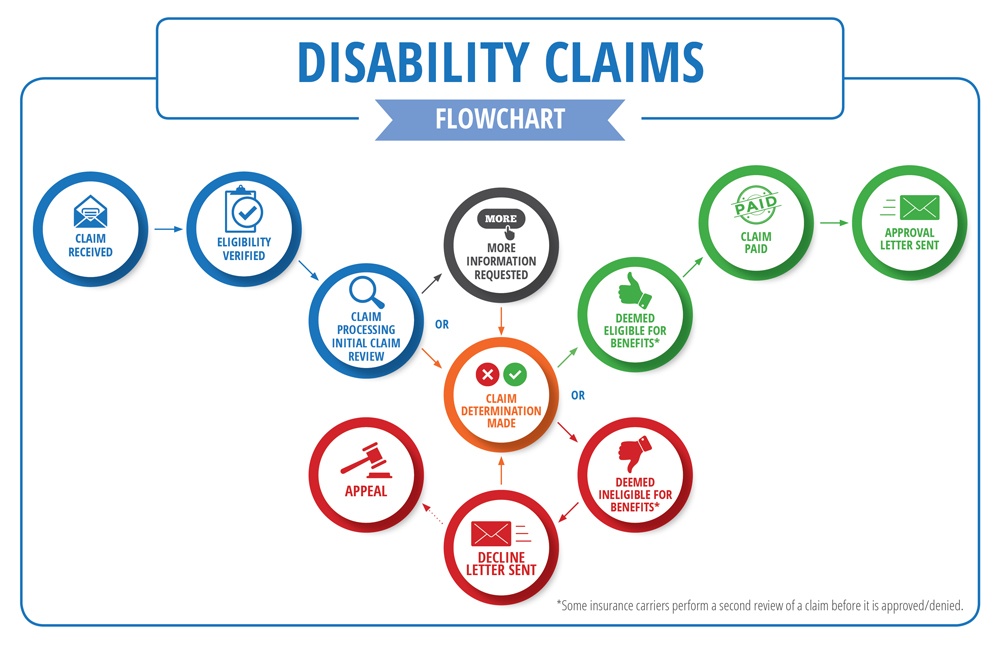

The flowchart below gives you an idea on how decisions are made and why the claims process may be quick for some and slower for others.

Why Your Claim May be Taking Longer than Anticipated

- Incomplete Claim

The insurance carrier needs a complete claim to start the determination process. When it comes to defining what a complete claim entails, there isn’t a cookie cutter definition because each claim is wholly unique.

The first step toward a complete claim is the claim application. It consists of three sections: the Employer, Employee, and Physician Statement. All forms need to be completed in full and submitted to the carrier. The claim will be considered pending until all three parts of the form are received. If any portion of the form is missing or incomplete, the status will remain pending.

Next, the claims examiner will perform an initial claims review. They will review all the paperwork submitted and decide if it’s enough to substantiate the claim.

Medical records may or may not be needed to make a final decision. A claim can be approved without medical records being submitted, if the physician doesn’t include them with their portion of the claim application. Other claims may require medical records to make a decision. The claim process could be slowed down or halted (pending claim) waiting for records.

A claims examiner may decide that more documentation is needed to substantiate the claim especially if records discuss other treatments/conditions not part of the initial documentation. The examiner may request additional medical records, vocational analysis, or payroll records. If additional documentation is needed a letter will be sent to the employee explaining why additional information is needed and a deadline to comply. Also, during this time telephonic interviews may take place with the employer and/or employee, as well as requests to the medical provider. The carrier may also utilize internal or external vendor resources to help aid in making a decision (medication professionals, vocational case managers, surveillance, etc.).

If no additional information is required, some carriers may perform a second review for accuracy before making a final determination. Once completed, an approval or denial letter is sent to the employee and copied to the employer.

If a claim is to be denied, the employee and employer will receive different versions of the denial letter. The employee’s letter will explain why the claim was denied and how to go about appealing the claim (if they want to pursue that avenue). The employer’s letter is more general in nature due to privacy reasons.

- Inaccurate Expectations of Turn-Around Time

Some insurance carriers may have a stated turn-around time for claim processing, but this number is often mistaken for the total amount of time a claim will take. The stated time is usually how long it takes the carrier to make a claim determination once the claim is considered complete (when all requested forms, records, etc.) are received.

If the claim is approved, claim payments are issued/scheduled immediately. The timeframe for approval could be delayed if the carrier determines that additional information is needed to support the disability and that is all dependent upon the unique circumstances of each claim.

Download our checklist to guide you through how to file a disability claim.