With 2019 just around the corner, public sector organizations with group health plans should be aware of changes to Affordable Care Act (ACA) requirements that take effect in 2019.

Cost-Sharing Limits

Check your plan’s cost-sharing limits:

- Review your plan’s out-of-pocket maximum to make sure it complies with the ACA’s limits for the 2019 plan year ($7,900 for self-only coverage and $15,800 for family coverage).

- If you have an HSA-compatible high deductible health plan (HDHP), keep in mind that your plan’s out-of-pocket maximum must be lower than the ACA’s limit. For 2019, the out-of-pocket maximum limit for HDHPs is $6,750 for self-only coverage and $13,500 for family coverage.

- If your plan uses multiple service providers to administer benefits, confirm that the plan will coordinate all claims for essential health benefits across the plan’s service providers, or will divide the out-of-pocket maximum across the categories of benefits, with a combined limit that does not exceed the maximum for 2019.

- Confirm that the plan applies the self-only maximum to each individual in the plan, regardless of whether the individual is enrolled in self-only or family coverage.

Affordability of Coverage

Under the ACA, an applicable large employer’s (ALE) health coverage is considered affordable if the employee’s required contribution to the plan does not exceed 9.5% of the employee’s household income for the taxable year (as adjusted each year). The adjusted percentage for 2019 is 9.86%.

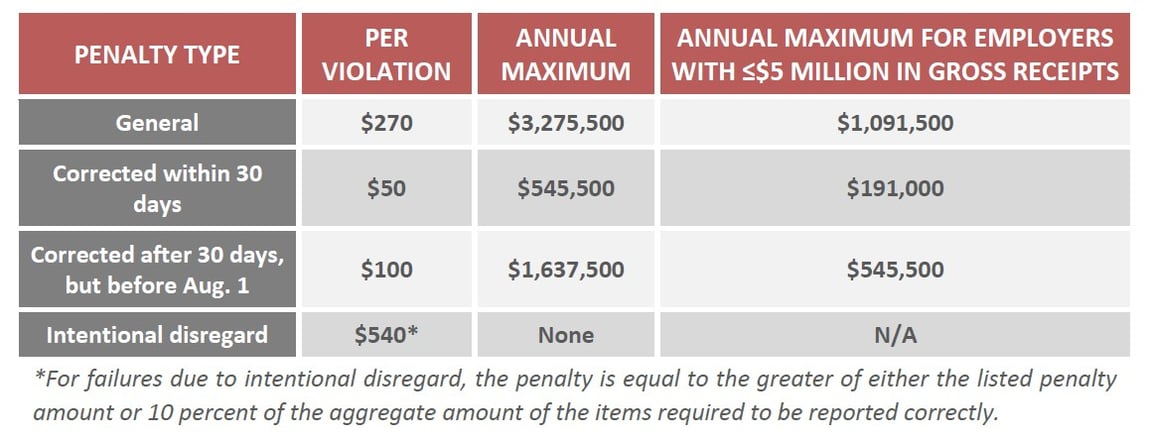

Penalties for ACA Reporting Violations

Self-funded or fully funded employers may need to comply with IRS reporting obligations included in Section 6055 and 6056. Failures related to filing or furnishing returns and statements in 2019 are as follows:

Download our 2019 ACA Compliance Checklist for detailed information. Employers should review these changes and make sure that they are still compliant.

Contact your NIS Benefits Consultant at 800.627.3660 if you have any questions.