3 minute read

Public sector organizations with group health plans should be aware of changes to Affordable Care Act (ACA) requirements that take effect in 2022.

Cost-Sharing Limits

Check your plan’s cost-sharing limits:

- Review your plan’s out-of-pocket maximum to make sure it complies with the ACA’s limits for the 2022 plan year ($8,700 for self-only coverage and $17,400 for family coverage).

- If you have an HSA-compatible high deductible health plan (HDHP), keep in mind that your plan’s out-of-pocket maximum must be lower than the ACA’s limit. For 2022, the out-of-pocket maximum limit for HDHPs is $7,050 for self-only coverage and $14,100 for family coverage.

- If your plan uses multiple service providers to administer benefits, confirm that the plan will coordinate all claims for essential health benefits across the plan’s service providers, or will divide the out-of-pocket maximum across the categories of benefits, with a combined limit that does not exceed the maximum for 2022.

- Confirm that the plan applies the self-only maximum to each individual in the plan, regardless of whether the individual is enrolled in self-only or family coverage.

Affordability of Coverage

Under the ACA, an applicable large employer’s health coverage is considered affordable if the employee’s required contribution to the plan does not exceed 9.5% of the employee’s household income for the taxable year (as adjusted each year). The adjusted percentage is 9.61% for 2022.

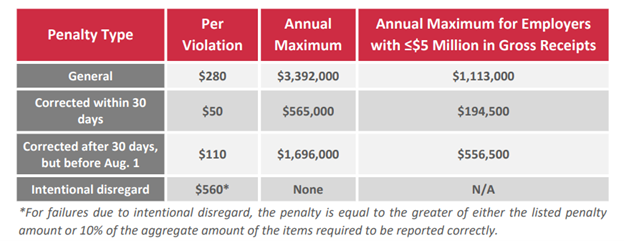

Penalties for ACA Reporting Violations

Employers that fail to comply with the Section 6055 or Section 6056 reporting requirements may be subject to reporting penalties for failure to file correct information returns and failure to furnish correct payee statements. The penalty amounts have not been released yet for 2022. Continue to use the 2021 penalties for now:

Health FSA Contributions

The annual pre-tax salary reduction contribution for a Health FSA for 2021 is $2,750. The 2022 limit has not yet been announced. Stayed tuned to our blog to learn when the new contribution limit is released.

- Once the 2022 health FSA limit is announced, confirm that your health FSA will not allow employees to make pre-tax contributions in excess of the limit for the 2022 plan year.

- If the 2022 limit is announced too late for your open enrollment, you can use the 2021 limit to ensure compliance.

- Communicate the health FSA limit to employees as part of the open enrollment process.

Download our 2022 ACA Compliance Checklist for detailed information. Employers should review these changes and make sure that they are still compliant.

This blog is intended to be a compilation of information and resources pulled from federal, state, and local agencies. This is not intended to be legal advice. For up to the minute information and guidance on COVID-19, please follow the guidelines of the Centers for Disease Control and Prevention (CDC) and your local health organizations.