National Insurance Services is not a law firm and no opinion, suggestion, or recommendation of the firm or its employees shall constitute legal advice. Readers are advised to consult with their own attorney for a determination of their legal rights, responsibilities and liabilities, including the interpretation of any statute or regulation, or its application to the readers’ business activities.

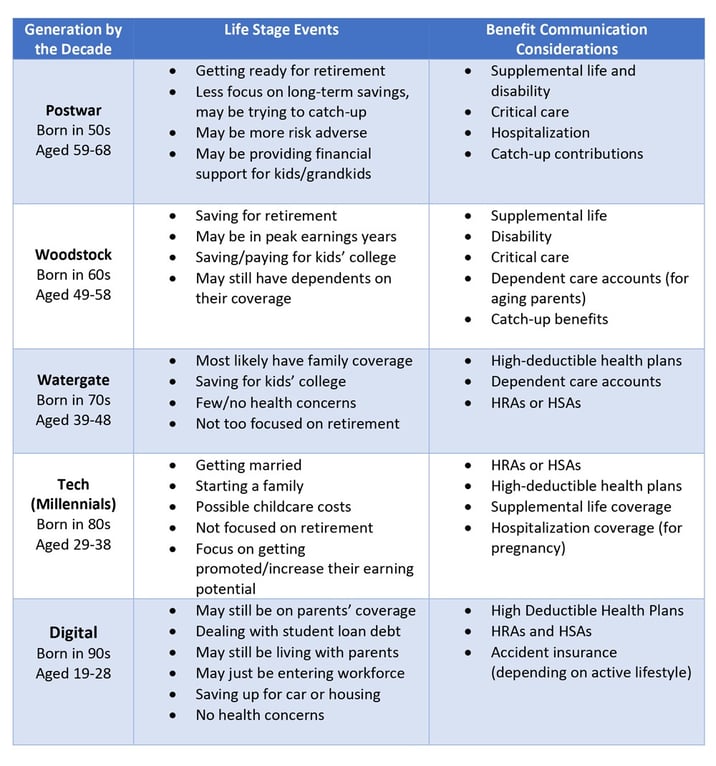

Using Generational Messaging to Discuss Benefits

Self-Funded Employers: Lower Orthopedic Costs Using Stem Cell Therapy

Employee Engagement Trends for 2018

Steve Smith

Steve Smith, Employee Benefits Consultant for National Insurance Services, has his energy level permanently set at “high.” His maxim is “work hard, play hard.” Steve’s an expert in getting groups of people working together for a higher cause. Minnesota schools, cities, and counties rely on Steve’s unique and creative ideas of engaging employees in their own health and wellness to lower utilization trends. He has 20+ years in the health insurance field doing compliance, cost mitigation, utilization, analytics, wellness plans, and strategic planning. Steve is a licensed insurance agent and holds the designations for Managed Healthcare Professional (The Health Insurance Association of America), Certified Patient Protection and Affordable Care Act Professional (National Association of Health Underwriters), and Group Benefits Disability Specialist (Hartford School of Insurance). He specializes in Employee Benefits Consulting for Minnesota schools, cities, and counties including fully insured, self-insured, and stop-loss plans.